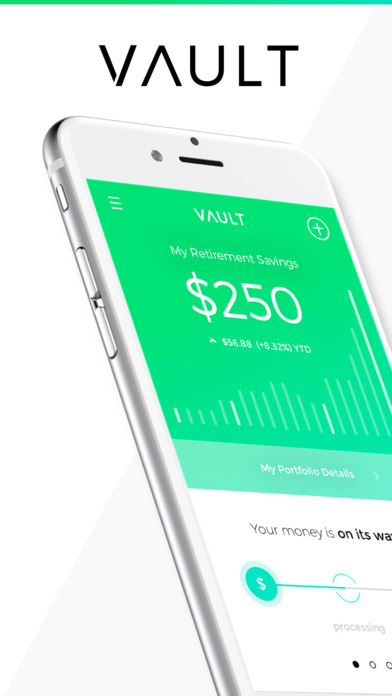

Vault - Save for retirement

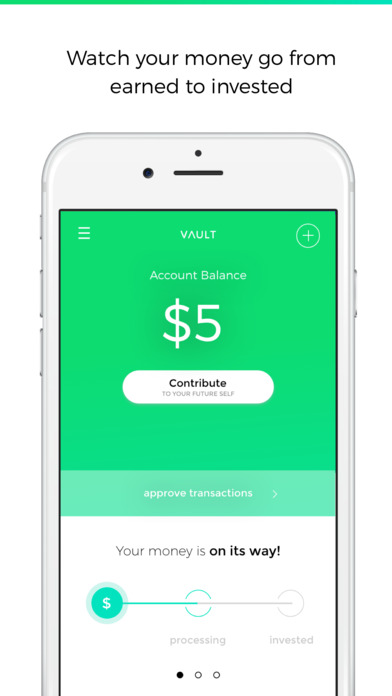

Vault helps you automatically save for retirement whenever you’re paid. We believe that investing is for everyone, regardless of what you make or when.

So whether you’re paid daily, weekly, monthly, or on a contract, our automatic and flexible contribution options let you set the pace that’s comfortable for you.

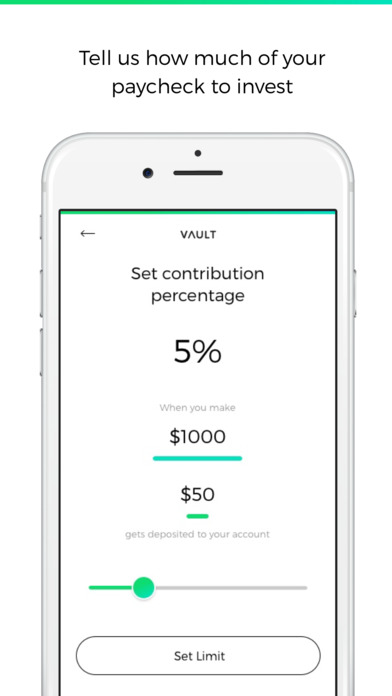

We’ll help you pick which of our three Individual Retirement Accounts (IRA) best fit your needs. To get started, just link your bank account and tell us what percentage of your income you’d like to invest. Even $1 or 1% is a great start. As a Vault customer, you’ll save money as you make money, and we’ll streamline your investing — even as your income fluctuates.

As an SEC-registered investment advisor, Vault takes investing your money seriously. We use smart technology to diversify your funds across up to 28,000 stocks and bonds, which maximizes return while reducing risk.

Features:

• $1/month: We keep our service charge low so you can invest more in yourself

• Quick Account Setup: Select and open your IRA in less than 60 seconds

• Smart Portfolios: We make intelligent investment decisions based on your timeline to retirement

• Start Where You Are: No minimum balance requirements — start with as little as $1 or 1% of your paycheck

• Invest What You Have: Chose to make a one-time contribution or invest a set-percentage of your income each time you’re paid

Multiple Plan Options:

Choose between our Self-Employed IRA (SEP IRA), Pre-Tax IRA (traditional IRA), or Post-Tax IRA (Roth IRA). Whether you’re looking for high contribution limits, tax-deductible contributions, or penalty-free withdrawals, we have an option for your needs.

Security:

• Bank-Level Security: We use 256-bit SSL encryption and securely store your personal data

• Privacy Protection: We will never sell your personal information to a third party.

Personalized Investing:

Portfolios are invested in low-cost ETFs (exchange traded funds), while your allocations are based on your time horizon.

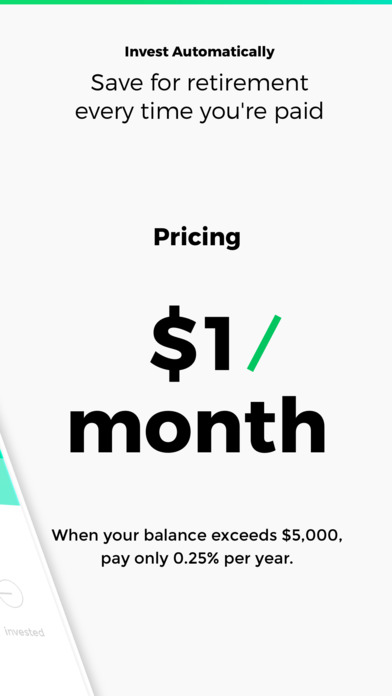

Pricing:

Transparent Pricing: Pay only $1/month. Accounts over $5,000 just 0.25% per year.

Protection:

Accounts are SIPC-protected up to $500,000 per customer against losses resulting from the failure of a broker-dealer. Much like how the FDIC insures bank deposits, SIPC insures investment accounts. You can find out more at http://www.sipc.org